Economy of Russia

| Economy of Russia | |

|---|---|

|

|

| Rank | 12th (nominal) / 7th (PPP) |

| Currency | Russian ruble (RUB) |

| Fiscal year | calendar year |

| Trade organizations | CIS, APEC, EURASEC, G-20, G8 and others |

| Statistics | |

| GDP |

$1.229 trillion (2009) (nominal; 12th)[1] $2.109 trillion (2009) (PPP; 7th)[1] |

| GDP growth | -7.9% (2009)[2] |

| GDP per capita |

$8,693 (2009) (nominal; 52nd)[1] $14,919 (2009) (PPP; 52nd)[1] |

| GDP by sector | agriculture: 4.6%, industry 39.1%, services 56.3% (2007 est.) |

| Inflation (CPI) | 8.8% (2009 est.)[3] |

| Population below poverty line |

15.8% (2007 est.) |

| Labour force | 75.81 million (2009 est.) |

| Labour force by occupation |

agriculture 10%, industry 31.9%, services 58.1% (2007 est.) |

| Unemployment | 8.9% (2009) |

| Main industries | coal, oil, gas, chemicals, and metals; all forms of machine building from rolling mills to high-performance aircraft and space vehicles; defense industries including radar, missile production, and advanced electronic components, shipbuilding; road and rail transportation equipment; communications equipment; agricultural machinery, tractors, and construction equipment; electric power generating and transmitting equipment; medical and scientific instruments; consumer durables, textiles, foodstuffs, handicrafts |

| Ease of Doing Business Rank | 120th[4] |

| External | |

| Exports | $295.6 billion (2009 est.) |

| Export goods | petroleum and petroleum products, natural gas, wood and wood products, metals, chemicals, and a wide variety of civilian and military manufactures |

| Main export partners | Netherlands 11.2%, Italy 8.1%, Germany 8%, Turkey 6%, Ukraine 5.1%, Poland 4.5%, China 4.3% (2008) |

| Imports | $196.8 billion (2009 est.) |

| Import goods | vehicles, machinery and equipment, plastics, medicines, iron and steel, consumer goods, meat, fruits and nuts, semifinished metal products |

| Main import partners | Germany 13.5%, China 13.2%, Japan 6.5%, Ukraine 6%, US 4.5%, Italy 4.3% (2008) |

| Gross external debt | $369.2 billion (31 December 2009 est.) |

| Public finances | |

| Public debt | 6.9% of GDP (2009 est.) |

| Revenues | $205.3 billion (2009 est.) |

| Expenses | $306.6 billion (2009 est.) |

| Main data source: CIA World Fact Book All values, unless otherwise stated, are in US dollars |

|

The economy of Russia is the twelfth largest economy in the world by nominal value and the seventh largest by purchasing power parity (PPP). Russia has an abundance of natural gas oil, coal, and precious metals. It is also rich in agriculture. Russia has undergone significant changes since the collapse of the Soviet Union, moving from a globally-isolated, centrally-planned economy to a more market-based and globally-integrated economy. Economic reforms in the 1990s privatized most industry, with notable exceptions in the energy and defense-related sectors. Nonetheless, the rapid privatization process, including a much criticized "loans-for-shares" scheme that turned over major state-owned firms to politically-connected "oligarchs", has left equity ownership highly concentrated. The protection of property rights is still weak and the private sector remains subject to heavy state interference.

Contents |

Economic history

Two fundamental and independent goals — macroeconomic stabilization and economic restructuring — the transition from central planning to a market-based economy. The former entailed implementing fiscal and monetary policies that promote economic growth in an environment of stable prices and exchange rates. The latter required establishing the commercial, and institutional entities — banks, private property, and commercial legal codes— that permit the economy to operate efficiently. Opening domestic markets to foreign trade and investment, thus linking the economy with the rest of the world, was an important aid in reaching these goals. The Gorbachev regime failed to address these fundamental goals. At the time of the Soviet Union's demise, the Yeltsin government of the Russian Republic had begun to attack the problems of macroeconomic stabilization and economic restructuring. By mid-1996, the results were mixed.

Since the collapse of the Soviet Union in 1991, Russia has tried to develop a market economy and achieve consistent economic growth. In October 1991, Yeltsin announced that Russia would proceed with radical, market-oriented reform along the lines of "shock therapy", as recommended by the United States and IMF.[5] However, this policy resulted in economic collapse, with millions being plunged into poverty and corruption and crime spreading rapidly.[6] Hyperinflation resulted from the removal of Soviet price controls and again following the 1998 Russian financial crisis. Assuming the role as the continuing legal personality of the Soviet Union, Russia took up the responsibility for settling the USSR's external debts, even though its population made up just half of the population of the USSR at the time of its dissolution.[7] When once all enterprises belonged to the state and were supposed to be equally owned amongst all citizens, they fell into the hands of a few, who became immensely rich. Stocks of the state-owned enterprises were issued, and these new publicly traded companies were quickly handed to the members of Nomenklatura or known criminal bosses. For example, the director of a factory during the Soviet regime would often become the owner of the same enterprise. During the same period, violent criminal groups often took over state enterprises, clearing the way by assassinations or extortion. Corruption of government officials became an everyday rule of life. Under the government's cover, outrageous financial manipulations were performed that enriched the narrow group of individuals at key positions of the business and government mafia. Many took billions in cash and assets outside of the country in an enormous capital flight.[8] That being said, there were corporate raiders such as Andrei Volgin engaged in hostile takeovers of corrupt corporations by the mid-1990s.

The largest state enterprises were controversially privatized by President Boris Yeltsin to insiders[9] for far less than they were worth.[5] Many Russians consider these infamous "oligarchs" to be thieves.[10] Through their immense wealth, the oligarchs wielded significant political influence.

Recovery

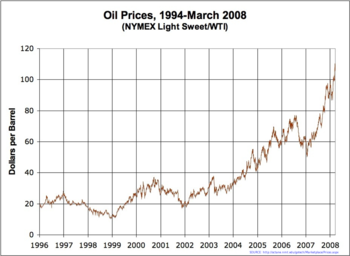

The Russian economy underwent tremendous stress as it moved from a centrally planned economy to a free market system. Difficulties in implementing fiscal reforms aimed at raising government revenues and a dependence on short-term borrowing to finance budget deficits led to a serious financial crisis in 1998. Lower prices for Russia's major export earners (oil and minerals) and a loss of investor confidence due to the Asian financial crisis exacerbated financial problems. The result was a rapid decline in the value of the ruble, flight of foreign investment, delayed payments on sovereign and private debts, a breakdown of commercial transactions through the banking system, and the threat of runaway inflation.

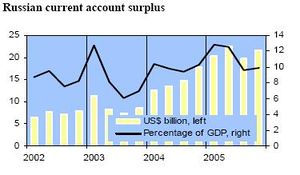

Russia, however, appears to have weathered the crisis relatively well. As of 2009 real GDP increased by the highest percentage since the fall of the Soviet Union at 8.1%, the ruble remains stable, inflation has been moderate, and investment began to increase again. In 2007 the World Bank declared that the Russian economy had achieved "unprecedented macroeconomic stability".[11] Russia is making progress in meeting its foreign debts obligations. During 2000-01, Russia not only met its external debt services but also made large advance repayments of principal on IMF loans but also built up Central Bank reserves with government budget, trade, and current account surpluses. The FY 2002 Russian Government budget assumes payment of roughly $14 billion in official debt service payments falling due. Large current account surpluses have brought a rapid appreciation of the ruble over the past several years. This has meant that Russia has given back much of the terms-of-trade advantage that it gained when the ruble fell by 60% during the debt crisis. Oil and gas dominate Russian exports, so Russia remains highly dependent upon the price of energy. Loan and deposit rates at or below the inflation rate inhibit the growth of the banking system and make the allocation of capital and risk much less efficient than it would be otherwise.

In 2003, the debt has risen to $19 billion due to higher Ministry of Finance and Eurobond payments. However, $1 billion of this has been prepaid, and some of the private sector debt may already have been repurchased. Russia continues to explore debt swap/exchange opportunities.

In the June 2002 G8 Summit, leaders of the eight nations signed a statement agreeing to explore cancellation of some of Russia's old Soviet debt to use the savings for safeguarding materials in Russia that could be used by terrorists. Under the proposed deal, $10 billion would come from the United States and $10 billion from other G-8 countries over 10 years.

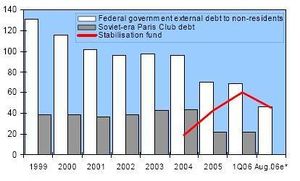

On January 1, 2004, the Stabilization fund of the Russian Federation was established by the Government of Russia as a part of the federal budget to balance it if oil price falls. Now the Stabilization fund of the Russian Federation is being modernized. The Stabilization Fund will be divided into two parts on February 1, 2008. The first part will become a reserve fund equal to 10 percent of GDP (10% of GDP equals to about $200 billion now), and will be invested in a similar way as the Stabilization Fund. The second part will be turned into the National Prosperity Fund of Russian Federation. Deputy Finance Minister Sergei Storchak estimates it will reach 600-700 billion rubles by February 1, 2008. The National Prosperity Fund is to be invested into more risky instruments, including the shares of foreign companies. Shyhkin, Maxim. "Stabilization Fund to Be Converted into National Prosperity". http://www.kommersant.com/p791856/new_fund_to_specialize_on_portfolio_investments/. Retrieved 2007-08-02.

Putin years

Under the Putin administration, Russia's economy saw the nominal Gross Domestic Product (GDP) double, climbing from 22nd to 11th largest in the world. The economy made real gains of an average 7% per year (2000: 10%, 2001: 5.7%, 2002: 4.9%, 2003: 7.3%, 2004: 7.2%, 2005: 6.5%, 2006: 7.7%, 2007: 8.1%, 2008: 5.6%), making it the 6th largest economy in the world in GDP(PPP). In 2007, Russia's GDP exceeded that of 1990, meaning it has overcome the devastating consequences of the Soviet era, 1998 financial crisis, and preceding recession in the 1990s.[12] On a per capita basis, Russian GDP was US$11,339 per individual in 2008, making Russians 57th richest on both a purchasing power and nominal basis.

During Putin's eight years in office, industry grew by 75%, investments increased by 125%,[12] and agricultural production and construction increased as well. Real incomes more than doubled and the average salary increased eightfold from $80 to $640.[13][14][15] The volume of consumer credit between 2000–2006 increased 45 times,[16][17] and during that same time period, the middle class grew from 8 million to 55 million, an increase of 7 times. The number of people living below the poverty line also decreased from 30% in 2000 to 14% in 2008.[12][18][19]

Inflation remained a problem however, as the government failed to contain the growth of prices. Between 1999–2007 inflation was kept at the forecast ceiling only twice, and in 2007 the inflation exceeded that of 2006, continuing an upward trend at the beginning of 2008.[12]

The Russian economy is still commodity-driven despite its growth. Payments from the fuel and energy sector in the form of customs duties and taxes accounted for nearly half of the federal budget's revenues. The large majority of Russia's exports are made up by raw materials and fertilizers,[12] although exports as a whole accounted for only 8.7% of the GDP in 2007, compared to 20% in 2000.[20]

There is also a growing gap between rich and poor in Russia. Between 2000–2007 the incomes of the rich grew from approximately 14 times to 17 times larger than the incomes of the poor. The income differentiation ratio shows that the 10% of Russia's rich live increasingly better than the 10% of the poor, amongst whom are mostly pensioners and unskilled workers in depressive regions. (See: Gini Coefficient)

Post-Putin years

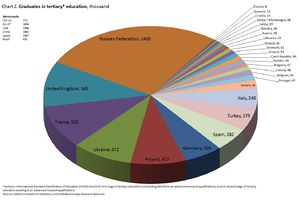

Arms sales have increased to the point where Russia is second (with 3/5ths the amount of US arms sales) in the world in sale of weapons, the IT industry has recorded a record year of growth concentrating on high end niches like algorithm design and microelectronics; Russia is now the world's third biggest destination for outsourcing software behind India and China. The space launch industry is now the world's second largest behind the European Ariane 5 and nuclear power plant companies are going from strength to strength, selling plants to China and India, and recently signed a joint venture with Toshiba to develop cutting edge power plants.

The civilian aerospace industry has developed the Sukhoi Superjet, as well as the upcoming MS-21 project to compete with Boeing and Airbus.

The recent global economic downturn has resulted in three major shocks to Russia's long-term economic growth, though. Oil prices dropped from $140 per barrel to $40 per barrel, a decrease in access to financing with an increase in sovereign and corporate bond spreads, and the reversal of capital flows from $80 billion in in-flows to $130 billion in out-flows have all served to crush fledgling Russian economic growth. In January 2009, industrial production was down almost 16% year to year, fixed capital investment was down 15.5% year to year, and GDP had shrunk 9% year to year.[21] However, in the second quarter the GDP rose by 7.5 percent on a quarterly basis indicating the beginning of economic recovery.

Macro Economy

Gross Domestic Product

.svg.png)

This is a chart of trend of gross domestic product of Russia at market prices estimated by the International Monetary Fund with figures in millions of Russian Rubles.[22]

| Year | Gross Domestic Product | US Dollar exchange |

|---|---|---|

| 1995 | 1,428,500 | 4.55 Rubles |

| 2000 | 7,305,600 | 28.13 Rubles |

| 2005 | 21,665,000 | 28.27 Rubles |

| 2008 | 39,952,177 | 23.52 Rubles |

| 2009 | 39,952,177 | 32.00 Rubles |

For purchasing power parity comparisons, the US Dollar is exchanged at 13.63 Rubles only. Average wages in 2007 hover around $42–51 per day.

Russia's GDP, estimated at $1,250 billion at 2007 exchange rates, increased by 8.1% in 2007 compared to 2006. Continued average inflation of approximately 10% and strict government budget led to the growth, while lower oil prices and ruble appreciation slowed it. As of November 2007, unemployment in Russia was at 5.9%[23], down from 10.4% in 2000. Combined unemployment and underemployment may exceed those figures. Industrial output in 2007 grew by 6.3% compared to 2006, driven by investment growth and private consumption demand.

As of 2005, oil industry and related services account for at least 40 per cent of the gross domestic product of Russia.

As of April 2008, the International Monetary Fund estimates that Russia's gross domestic product (nominal) will grow from its 2007 value of $1,289,582 million to $3,462,998 million by 2013, a 168% increase. Its GDP PPP is estimated to grow from $2,087,815 to $3,330,623 in the same time, which would make it the second largest economy in Europe in terms of purchasing power.[24]

Monetary policy

The exchange rate stabilized in 1999; after falling from 6.5 rubles/dollar in August 1998 to about 25 rubles/dollar by April 1999, one year later it had further depreciated only to about 28.5 rubles/dollar. As of June 2002, the exchange rate was 31.4 rubles/dollar, down from 29.2 rubles/dollar the year before. After some large spikes in inflation following the August 1998 economic crisis, inflation has declined steadily. Cumulative consumer price inflation for 2001 was 18.6% slightly below the 20.2% inflation rate of the previous year but above the inflation target set in the 2001 budget. The Central Bank's accumulation of foreign reserves drove inflation higher and that trend is expected to continue. The 2002 budget estimates an inflation rate of 12%, but the World Bank predicts inflation will stay above 15% in 2002.

Fiscal Policy

Central and local government expenditures are about equal. Combined they come to about 38% of GDP. Fiscal policy has been very disciplined since the 1998 debt crisis. The overall budget surplus for 2001 was 2.4% of GDP, allowing for the first time in history for the next year's budget to be calculated with a surplus (1.63% of GDP). Much of this growth, which exceeded most expectations for the third consecutive year, was driven by consumption demand. Analysts remain skeptical that high rates of economic growth will continue, particularly since Russia's planned budgets through 2005 assume that oil prices will steadily increase. Low oil prices would mean that the Russian economy would not achieve its projected growth. However, high oil prices also would have negative economic effects, as they would cause the ruble to continue to appreciate and make Russian exports less competitive. The 2007 budget law corporates a 25% increase in spending, much of it for public-sector salary increases, pension increases and social programmes. Spending on education is targeted to increase by 60% relative to the 2006 legislation and spending on healthcare is to increase by 30%. Funding for the four "national projects", undertakings in agriculture, education, housing and healthcare, will increase by 85 billion roubles over the 2006 figure to 230 billion rubles.

Law

Lack of legislation and, where there is legislation, lack of effective law enforcement, in many areas of economic activity is a pressing issue. During 2000 and 2001, changes in government administration increased the power of the central government to compel localities to enforce laws. Progress has been made on pension reform and reform of the electricity sector. Nonetheless, taxation and business regulations are unpredictable, and legal enforcement of private business agreements is weak. Attitudes left over from the Soviet period will take many years to overcome. Government decisions affecting business have often been arbitrary and inconsistent. Crime has increased costs for both local and foreign businesses. On the positive side, Russian businesses are increasingly turning to the courts to resolve disputes. The passage of an improved bankruptcy code in January 1998 was one of the first steps. In 2001, the Duma passed legislation for positive changes within the business and investment sector; the most critical legislation was a deregulation package. This trend in legislation is continued through 2002, with the new corporate tax code going into effect.

Natural resources

The mineral-packed Ural Mountains and the vast oil, gas, coal, and timber reserves of Siberia and the Russian Far East make Russia rich in natural resources. However, most such resources are located in remote and climatically unfavorable areas that are difficult to develop and far from Russian ports. Oil and gas exports continue to be the main source of hard currency. Russia is a leading producer and exporter of minerals, gold, and all major fuels. The Russian fishing industry is the world's fourth-largest, behind Japan, the United States, and China. Natural resources, especially energy, dominate Russian exports. Ninety percent of Russian exports to the United States are minerals or other raw materials.

Expecting the area to become more accessible as climate change melts Arctic ice, and believing the area contains large reserves of untapped oil and natural gas, on August 2, 2007, Russian explorers, in submersibles, planted the Russian flag on the Arctic seabed, staking a claim to energy sources right up to the North Pole. Reaction to the event was mixed: President Vladimir Putin congratulated the explorers for "the outstanding scientific project", while Canadian officials stated the expedition was just a public show.[25]

Under the Federal Law "On Continental Shelf Development" upon proposal from the federal agency managing the state fund of mineral resources or its territorial offices the Russian government approves the list of some sections of the mineral resources that are passed for development without any contests and auctions, some sections of federal importance of the Russian continental shelf, some sections of the mineral resources of federal importance that are situated in Russia and stretch out on its continental shelf, some gas deposits of federal importance that are handed over for prospecting and developing the mineral resources under a joint license. The Russian government is also empowered to decide on the handover of the foresaid sections of the mineral resources for development without any contests and auctions.

Sectors

Industry

Russia is one of the most industrialized of the former Soviet republics. However, years of very low investment have left much of Russian industry antiquated and highly inefficient. Besides its resource-based industries, it has developed large manufacturing capacities, notably in machinery. Russia inherited most of the defence industrial base of the Soviet Union, so armaments are the single-largest manufactured goods export category for Russia. Efforts have been made with varying success over the past few years to convert defence industries to civilian use.

Defense industry

Russia's defense industry employs 2.5 – 3 million people, accounting for 20% of all manufacturing jobs.[26] Russia is the world's second largest conventional arms exporter after the United States.[27] The most popular types of weaponry bought from Russia are Sukhoi and MiG fighters, air defense systems, helicopters, battle tanks, armored personnel carriers and infantry fighting vehicles.[27] The research organization Centre for Analysis of Strategies and Technologies ranked the air defense system producer Almaz-Antey as the industry's most successful company in 2007, followed by aircraft-maker Sukhoi. Almaz-Antey's revenue that year was $3.122 billion, and it had a work force of 81,857 people.[28]

Electronics

Russia is experiencing a regrowth of Electronics and Microelectronics, with the revival of JCS Mikron.[29][30].

Telecom

Russia's telecommunications industry is growing in size and maturity. As of 31 December 2007, there were an estimated 4,900,000 broadband lines in Russia.[31] Over 72% of the broadband lines were via cable modems and the rest via DSL.

In 2006, there were more than 300 BWA operator networks, accounting for 5% of market share, with dial-up accounting for 30%, and Broadband Fixed Access accounting for the remaining 65%. In December 2006, Tom Phillips, chief government and regulatory affairs officer of the GSM Association stated:

-

- "Russia has already achieved more than 100% mobile penetration thanks to the huge popularity of wireless communications among Russians and the government's good work in fostering a market driven mobile sector based on strong competition."[32]

While there is a lot of interest in a national broadband network, as of January 2007 there still wasn't one.[33]

Agriculture

Russia comprises roughly three-quarters of the territory of the former Soviet Union. Following the breakup of the Soviet Union in 1991 and after nearly ten years of decline, Russian agriculture begun to show signs of improvement due to organizational and technological modernization. Northern areas concentrate mainly on livestock, and the southern parts and western Siberia produce grain. Restructuring of former state farms has been an extremely slow process. The new land code passed by the Duma in 2002 should speed restructuring and attract new domestic investment to Russian agriculture. Private farms and garden plots of individuals account for over one-half of all agricultural production.

Trade

In 1999, exports were up slightly, while imports slumped by 30.5%. As a consequence, the trade surplus ballooned to $33.2 billion, more than double the previous year's level. In 2001, the trend shifted, as exports declined while imports increased. World prices continue to have a major effect on export performance, since commodities, particularly oil, natural gas, metals, and timber comprise 80% of Russian exports. Ferrous metals exports suffered the most in 2001, declining 7.5%. On the import side, steel and grains dropped by 11% and 61%, respectively.

Most analysts predicted that these trade trends would continue to some extent in 2002. In the first quarter of 2002, import expenditures were up 12%, increased by goods and a rapid rise of travel expenditure. The combination of import duties, a 20% value-added tax and excise taxes on imported goods (especially automobiles, alcoholic beverages, and aircraft) and an import licensing regime for alcohol still restrain demand for imports. Frequent and unpredictable changes in customs regulations also have created problems for foreign and domestic traders and investors. In March 2002, Russia placed a ban on poultry from the United States. In the first quarter of 2002, exports were down 10% as falling income from goods exports was partly compensated for by rising services exports, a trend since 2000. The trade surplus decreased to $7 billion from well over $11 billion the same period last year.

Foreign trade rose 34% to $151.5 billion in the first half of 2005, mainly due to the increase in oil and gas prices which now form 64% of all exports by value. Trade with CIS countries is up 13.2% to $23.3 billion. Trade with the EU forms 52.9%, with the CIS 15.4%, Eurasian Economic Community 7.8% and Asia-Pacific Economic Community 15.9% [1].

Trade volume between China and Russia reached $29.1 billion in 2005, an increase of 37.1% compared with 2004. China’s export of machinery and electronic goods to Russia grew 70%, which is 24% of China’s total export to Russia in the first 11 months of 2005. During the same time, China’s export of high-tech products to Russia increased by 58%, and that is 7% of China’s total exports to Russia. Also in this time period border trade between the two countries reached $5.13 billion, growing 35% and accounting for nearly 20% of the total trade. Most of China’s exports to Russia remain apparel and footwear.

Russia is China’s eighth largest trade partner and China is now Russia’s fourth largest trade partner.

China now has over 750 investment projects in Russia, involving $1.05 billion. China’s contracted investment in Russia totaled $368 million during January-September 2005, twice that in 2004.

Chinese imports from Russia are mainly those of energy sources, such as crude oil, which is mostly transported by rail, and electricity exports from neighboring Siberian and Far Eastern regions. In the near future, exports of both of these commodities are set to increase, as Russia is building the Eastern Siberia–Pacific Ocean oil pipeline with a branch to Chinese border, and Russian power grid monopoly UES is building some of its hydropower stations with a view of future exports to China.

Information Technology

The IT market is one of the most dynamic sectors of the Russian economy. Russian software exports have risen from just $120 million in 2000 to $1.5 billion in 2006. Since the year 2000 the IT market has demonstrated growth rates of 30-40 percent a year, growing by 54% in 2006 alone. The biggest sector in terms of revenue is system and network integration, which accounts for 28.3% of the total market revenues [2]. Meanwhile the fastest growing segment of the IT market is offshore programming. The industry of software development outsourcing crossed the mark of $1 billion of total revenues in 2005 and reached $1.8 billion in 2006 [3]. Market analysts predict this indicator to increase tenfold by 2010 [4]. Currently Russia controls 3 percent of the offshore software development market and is the third leading country (after India and China) among software exporters. Such growth of software outsourcing in Russia is caused by a number of factors. One of them is the supporting role of the Russian Government. The Government has launched a program promoting construction of IT-oriented technology parks (Technoparks) - special zones that have an established infrastructure and enjoy a favorable tax and customs regime, in seven different places around the country: Moscow, Novosibirsk, Nizhny Novgorod, Kaluga, Tumen, Republic of Tatarstan and St. Peterburg Regions. Another factor stimulating the IT sector growth in Russia is the presence of global technology corporations such as Intel, Motorola, Sun Microsystems, Boeing, Nortel and others, which have intensified their software development activities and opened their R&D centers in Russia.

Nanotechnology

In its push to diversify Russia's research and development in emerging technologies, The Putin government has announced a massive $7 billion investment program in nanotechnology.[34] As part of the program, during 2007, $5 billion is being invested into a new state corporation, Rosnanotech, that will be responsible for overseeing and coordinating research in the area.

In criticism of the initiative, it has been noted that the Russian nanotech program will receive three times more state funding than the rest of Russia's scientists put together.[35]

Apart from public funding, Mikhail Prokhorov, a leading Russian metals and banking tycoon, has announced the creation of a $17.5 billion holding company that will focus on high-tech investments, including alternative energy and nanotechnology.

Transportation

Investment

In 1999, investment increased by 4.5%, the first such growth since 1990. Investment growth has continued at high rates from a very low base, with an almost 30% increase in total foreign investments in 2001 compared to the previous year. Higher retained earnings, increased cash transactions, the positive outlook for sales, and political stability have contributed to these favorable trends. Foreign investment in Russia is very low. Cumulative investment from U.S. sources of about $4 billion are about the same as U.S. investment in Costa Rica. Over the medium-to-long term, Russian companies that do not invest to increase their competitiveness will find it harder either to expand exports or protect their recent domestic market gains from higher quality imports.

Foreign direct investment, which includes contributions to starting capital and credits extended by foreign co-owners of enterprises, rose slightly in 1999 and 2000, but decreased in 2001 by about 10%. Foreign portfolio investment, which includes shares and securities, decreased dramatically in 1999, but has experienced significant growth since then. In 2001, foreign portfolio investment was $451 million, more than twice the amount from the previous year. Inward foreign investment during the 1990s was dwarfed by Russian capital flight, estimated at about $15 billion annually. During the years of recovery following the 1998 debt crisis, capital flight seems to have slowed. Inward investment from Cyprus and Gibraltar, two important channels for capital flight from Russia in recent years, suggest that some Russian money is returning home.

A significant drawback for investment is the banking sector, which lacks the resources, the capability, and the trust of the population that it would need to attract substantial savings and direct it toward productive investments. Russia's banks contribute only about 3% of overall investment in Russia. While ruble lending has increased since the August 1998 financial crisis, loans are still only 40% of total bank assets. The Central Bank of Russia reduced its refinancing rate five times in 2000, from 55% to 25%, signaling its interest in lower lending rates. Interest on deposits and loans are often below the inflation rate. The poorly developed banking system makes it difficult for entrepreneurs to raise capital and to diversify risk. Banks still perceive commercial lending as risky, and some banks are inexperienced with assessing credit risk.

Money on deposit with Russian banks represents only 7% of GDP. Sberbank receives preferential treatment from the state and holds 73% of all bank deposits. It also is the only Russian bank that has a federal deposit insurance guarantee. In March 2002, Sergei Ignatyev replaced Viktor Gerashchenko as Chairman of the Russian Central Bank. Under his leadership, necessary banking reforms, including stricter accounting procedures and federal deposit insurance, are likely to be implemented.

Strategic Sectors

In the Russian law, there are sectors of the Economy who are considered to be crucial for national security and foreign companies are restricted from owning them. Investments in the so-called Strategic Sectors are defined in a law Adopted by the Federal Assembly of Russia.

Types of legal entities in Russia

- IP (Индивидуальный предприниматель) - Russian "Individual entrepreneur"

- OOO (Общество с ограниченной ответственностью, ООО) - Russian "Limited liability company"

- ZAO (Закрытое акционерное общество, ЗАО) - Russian "Private joint-stock company"

- OAO (Открытое акционерное общество, ОАО) - Russian "Public joint-stock company"

- ANO (Автономная некоммерческая организация, АНО) - Russian "Autonomous non-profit organization"

- GP or GUP (Государственное унитарное предприятие, ГП or ГУП) - Russian "Unitary state enterprise"

- Фонд - Russian "Fund"

- PK (Производственный кооператив, ПK) - Russian "Production Cooperative"

- PP (Политические партии, ПП) - Russian "Political party"

See also

|

|||||||||||||||||||||||

|

Stocks

- RTS Stock Exchange

- RTS Index

- MICEX

References

- ↑ 1.0 1.1 1.2 1.3 "Russia". International Monetary Fund. http://www.imf.org/external/pubs/ft/weo/2010/01/weodata/weorept.aspx?sy=2007&ey=2010&scsm=1&ssd=1&sort=country&ds=.&br=1&c=922&s=NGDPD%2CNGDPDPC%2CPPPGDP%2CPPPPC%2CLP&grp=0&a=&pr.x=61&pr.y=10. Retrieved 2009-10-01.

- ↑ Динамика реального объема элементов использованного ВВП

- ↑ http://www.polit.ru/economy/2010/01/13/record.html

- ↑ "Doing Business in Russia 2010". World Bank. http://www.doingbusiness.org/ExploreEconomies/?economyid=159. Retrieved 2010-08-20.

- ↑ 5.0 5.1 "Nuffield Poultry Study Group—Visit to Russia". pg 7. The BEMB Research and Education Trust. http://www.bembtrust.org.uk/Russia%20Report%20no%20app.pdf. Retrieved 2007-12-27.

- ↑ "Members". APEC Study Center; City University of Hong Kong. http://www.fb.cityu.edu.hk/research/apec/index.cfm?page=members. Retrieved 2007-12-27.

- ↑ "Russia pays off USSR’s entire debt, sets to become crediting country". Pravda.ru. http://english.pravda.ru/russia/economics/22-08-2006/84038-paris-club-0. Retrieved 2007-12-27.

- ↑ "Russia: Clawing Its Way Back to Life (int'l edition)". BusinessWeek. http://www.businessweek.com/1999/99_48/b3657252.htm. Retrieved 2007-12-27.

- ↑ Nicholson, Alex. "Metal is the latest natural resource bonanza for Russia". International Herald Tribune. http://www.iht.com/articles/2007/08/14/business/metal.php.

- ↑ Page, Jeremy (2005-05-16). "Analysis: punished for his political ambitions". London: The Times. http://www.timesonline.co.uk/tol/news/world/article523129.ece. Retrieved 2007-12-27.

- ↑ Russia attracts investors despite its image BBC News Retrieved on March 2008

- ↑ 12.0 12.1 12.2 12.3 12.4 Russia’s economy under Vladimir Putin: achievements and failures RIA Novosti Retrieved on May 1, 2008

- ↑ Russians weigh an enigma with Putin’s protégé MSNBC Retrieved on May 3, 2008

- ↑ Medvedev is new Russian president Al Jazeera Retrieved on May 7, 2008

- ↑ Putin’s Economy – Eight Years On Russia Profile, Retrieved on April 23, 2008

- ↑ РОЗНИЧНЫЙ ПОДХОД. Российские банки борются за частников

- ↑ Ежегодно объем потребительского кредитования в России удваивается

- ↑ ОСНОВНЫЕ СОЦИАЛЬНО-ЭКОНОМИЧЕСКИЕ ИНДИКАТОРЫ УРОВНЯ ЖИЗНИ НАСЕЛЕНИЯ

- ↑ CIA - The World Factbook - Russia

- ↑ Rosstat Confirms Record GDP Growth Kommersant Retrieved on May 5, 2008

- ↑ Russia in the Global Storm. http://www.carnegieendowment.org/events/?fa=eventDetail&id=1326. April 21, 2009.

- ↑ IMF 2007 - 2013 estimates

- ↑ CIA Factbook - Russia Retrieved on April 19, 2008

- ↑ IMF Russia Retrieved on April 19, 2008

- ↑ "Russia plants flag on Arctic floor". MOSCOW, Russia (Reuters) (CNN). 2007-08-02. http://www.cnn.com/2007/WORLD/europe/08/02/arctic.sub.reut/index.html?eref=yahoo. Retrieved 2007-08-02.

- ↑ "Russian defense industry production up 2.5% in 1Q09". RIA Novosti. 2009-06-02. http://en.rian.ru/russia/20090602/155148607.html. Retrieved 2009-06-02.

- ↑ 27.0 27.1 "Russian arms exports exceed $8 bln in 2008". RIA Novosti. 2008-12-16. http://en.rian.ru/russia/20081216/118889555.html. Retrieved 2010-01-06.

- ↑ Makienko, Konstantin (2008-07-24). "Successful Year for Aerospace Manufacturers". Russia & CIS Observer. http://cast.ru/eng/?id=319. Retrieved 2010-01-06.

- ↑ "Electronics regrowth in Russia". http://eetimes.eu/187200078.

- ↑ "Electronics in Russia". http://english.pravda.ru/main/18/89/357/11642_Russia.html.

- ↑ Internet usage statistic

- ↑ http://electronics.ihs.com/news/2006/gsma-3g-russia.htm retrieved 2007-08-02

- ↑ http://www.ospint.com/text/d/3915045/ retrieved 2007-08-02

- ↑ Nanotechnology state investment until 2015

- ↑ Russia Bids to Become a Tech Tiger

This article incorporates public domain material from websites or documents of the Library of Congress Country Studies. - Soviet Union

This article incorporates public domain material from websites or documents of the Library of Congress Country Studies. - Soviet Union

|

|||||||||||||||||||||||||||||

|

||||||||

|

|||||||

|

||||||||

|

||||||||||||||

|

||||||||||||||